Health & Welfare

Chuze offers a variety of benefits to eligible employees. Our health and welfare benefits go beyond just medical, dental and vision. We offer employer-paid life insurance, extra life insurance if you want to increase your amount, short-term disability, and supplemental plans to help you with those out-of-pocket costs that you may find with your regular medical insurance. Want to check out all of the benefits Chuze offers? Please click on the Chuze Benefits Guide below!

BENEFITS GUIDE

Sep 2024 - Aug 2025

Click below for cost, how to find a doctor, and full plan details!

Benefits Eligibility

An employee who is classified as Full-Time is considered to be a benefit eligible employee and able to participate in the company sponsored health and welfare plans. An employee who is classified as Part-Time is considered to be a non-benefit eligible employee and unable to participate in the company sponsored health and welfare plans, but may still be eligible for medical coverage if their stability period, as defined by the Affordable Care Act, is Full-Time. For more information, please refer to appendix B in the plan document.

Coverage Start

Coverage will start after the following:

Insurance plans selected during your New Hire window :

Medical, Dental, Vision, Accident, and Hospital Enrollment window is 15 days only from the hire date and effective 31 days from the hire date. Life, Ad&d, STD, and LTD Enrollment window is 15 days only from the hire date and effective the first of the month following 30 days from the hire date.

Selections made during Open Enrollment are effective on September 1st of that plan year.

Coverage effective dates for mid-year entries due to Qualifying Events vary.

Selections and Changes

Eligible employees can make benefits election and changes only during the following: Within 15 days of your hire date as a full-time employee Within 15 days of your status change to full-time During the annual Open Enrollment period Within 30 days of a qualifying life or family status event (applies only to certain changes)

Eligible Dependents

Employees can enroll the following eligible dependents: Spouse Registered Domestic Partner* Children up to age 26. Children include: Biological and adopted children (including those placed in your home for adoption) Stepchildren and domestic partner children Children for whom you are responsible to provide health coverage under a qualified medical child support order Chuze performs periodic reviews to verify family members’ eligibility for enrollment in the benefit plans. Chuze and the insurance carriers reserve the right to request documentation to verify eligibility. Note: Under the Internal Revenue Code, if your Domestic Partner does not qualify as your tax dependent, the fair market value of your Domestic Partner’s health coverage, minus any post-tax contributions made by you, will be included in your gross income and subject to federal tax including Social Security and federal income tax withholdings, as well as being reported as taxable earnings on your W-2 Form. State tax treatment of Domestic Partner benefits varies by state. Your gross income for state tax purposes will be adjusted accordingly based on the state in which you reside. See the company policy on Domestic Partnership coverage below:

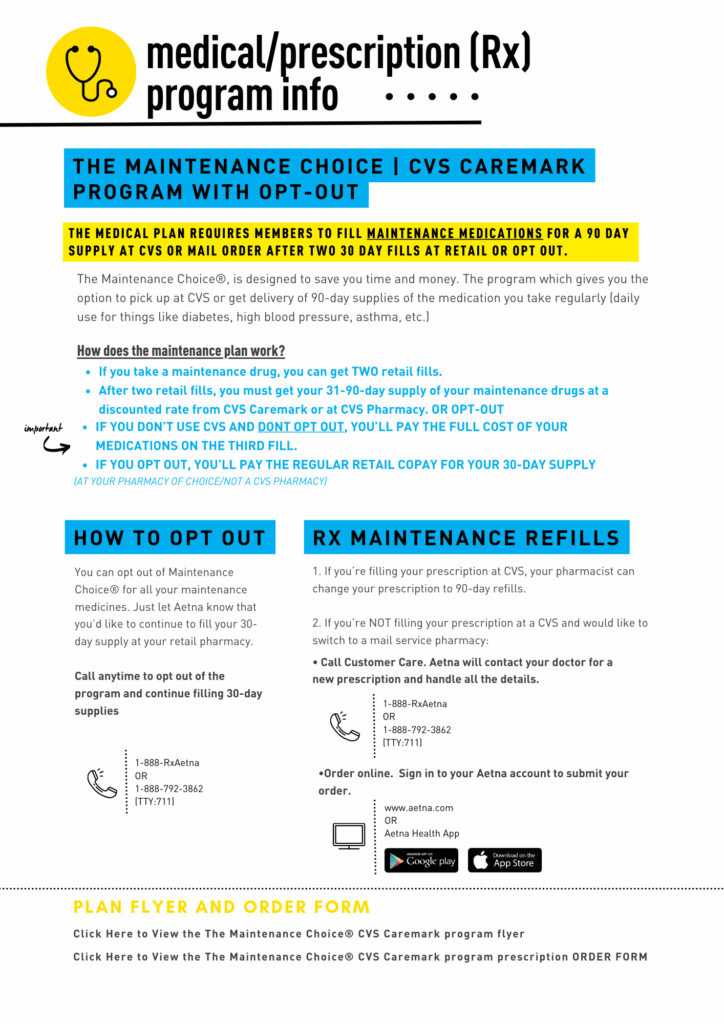

Aetna (Medical, Dental, & Vision)

A Qualified Life Event (QLE) is a significant life change that impacts your health insurance options or requirements. According to the IRS, a QLE must either:

- Affect your insurance needs, or

- Change the health plans you qualify for.

When a QLE occurs, it triggers a special enrollment period, allowing you to add, change, or drop coverage outside of the standard open enrollment period.

If you believe you have experienced a QLE but aren’t sure how to proceed, please contact TotalRewards@ChuzeFitness.com, and we’ll guide you through the next steps.

Category | Examples of Qualifying Life Events |

Loss of health-care coverage |

|

Changes in household |

|

Other qualifying events |

|

Qualifying Life Events are evaluated on a case-by-case basis and require documentation related to the QLE

Per the IRS (Section 125 regulations), employees may not alter their plan selections mid-year without a valid Qualifying Life Event (QLE). This is not a Chuze policy, this is an IRS regulation that we must follow.

- Log in to UKG

- Click on Myself > Benefits > Update My Benefits

- Select the applicable Life Event

- Enter the event date (the date the qualified life event occurred)

- Review, Add, or Update your Dependents

- Make your selections

- Review your cart and Check out

Once you check out, UKG will open a document request for you to upload the required proof of your Qualified Life Event (QLE). All QLEs must be submitted with supporting documentation within 30 days of the event. You may upload the required documents through UKG or email them to TotalRewards@ChuzeFitness.com.

Next Steps:

- The Total Rewards Team will review your elections and documentation.

- If your QLE is approved, you will receive a benefits confirmation email from UKG.

- If your QLE is rejected or requires additional information, you will receive an email with further instructions.

- Log in to UKG

- Click on Myself > Benefits > Manage My Benefits

- Click Profile on the side menu, then select My Family or My Beneficiaries to add or update existing dependents

Adding dependents and beneficiaries does not automatically add them to benefit plans. If you need to add dependents to your plan, please see “Add insurance coverage after a valid Qualifying Life Event (QLE) occurs”

BASIC LIFE INSURANCE PAID BY CHUZE 100%

Chuze Fitness provides basic Life Insurance of 1x salary up to a maximum of $200,000 with a minimum of $50,000 to all eligible Full-Time employees, at no cost to you. You may purchase Life and AD&D in addition to the company-provided coverage. Note: Benefit amounts over $50,000 are subject to imputed income and may be taxable. *if you do not wish to get free life insurance and have imputed income please decline during your enrollment*

September 1, 2024 - August 31, 2025 Health and Welfare Policy Documents

Medical:

Dental:

Vision:

Accident Insurance:

Critical Illness Insurance:

Hospital Care:

Short-Term Disability Insurance:

Life Insurance:

Medical - Spanish:

Dental - Spanish:

Vision - Spanish:

Accident Insurance - Spanish:

Critical Illness Insurance - Spanish:

Hospital Care - Spanish:

Short-Term Disability Insurance - Spanish:

Supplemental Documents

Previous Years Health and Welfare Policy Documents

- 2023-2024 Health and Welfare Policy Documents

- 2023-2024 Health and Welfare Policy Documents (Group 4 ONLY)

- 2022-2023 Health and Welfare Policy Documents

- 2022-2023 Summary Annual Report (SAR)

- 2021-2022 Health and Welfare Policy Documents

- 2020-2021 Health and Welfare Policy Documents

- 2019-2020 Health and Welfare Policy Documents

- 2018-2019 Health and Welfare Policy Documents

FAQ's

- Click HERE for the Aetna OAMC (ALL STATES) network.

- Click HERE for the Aetna HMO (CA ONLY) network.

- Continue as a guest: Enter a 5-digit zip code or city.

- Click “Medical Doctors & Specialists”.

- Click “All Primary Care Physicians,” and the provider listing will appear.

- Your provider listing will include specific providers currently accepting your Aetna Health Plan. You must call and check with the provider before scheduling your appointment or receiving services to confirm if they are still participating in Aetna’s network.

- Member Service phone numbers for Aetna plan

- HMO CA ONLY – (800) 445-5299

- OAMC 1000 & 3000 – (877) 204-9186

CALIFORNIA ONLY - HMO FAQ's

A Health Maintenance Organization (HMO) health plan offers a local and sometimes limited network of doctors and hospitals for you to choose from.

HMO plan important key features:

- You will need to select an in-network primary care provider (PCP) for yourself and your covered dependents. You can change your PCP at any time.

- The PCP you choose will coordinate your health care needs and refer you to specialists as needed, except for OB/GYN (OB/ GYN and PCP must be in the same medical group) and chiropractic services.

- You do not need a referral from your PCP to see a mental health provider; however, you can call Aetna directly to speak with a mental health team member 877.204.9186 who will refer you to an in-network mental health provider or confirm if your specific mental health provider is in-network.

- Aetna may need to pre-certify hospitalizations and other outpatient care, but there’s no paperwork for you when using in-network providers.

Yes, you and your covered dependents can only see a provider within the AETNA HMO network.

If you get medical care outside of the plan’s network (such as a physician, hospital, clinic or pharmacy), those out-of-network services will only be covered if the treatment is considered an emergency or urgent care as defined by your health plan documents.

HMO CALIFORNIA ONLY:

- Click HERE for the Aetna HMO network.

- Continue as a guest: Enter a 5-digit zip code or city.

- Click “Medical Doctors & Specialists”.

- Click “All Primary Care Physicians,” and the provider listing will appear.

- Your provider listing will include specific providers currently accepting your Aetna Health Plan. You must call and check with the provider before scheduling your appointment or receiving services to confirm if they are still participating in Aetna’s network.

Most HMO plans are very attractive because of their inexpensive costs for the participant. Most services can be paid with a small copay and there is usually no deductible or a very small deductible. It is important to know the difference between an HMO and a traditional PPO plan to determine if the HMO plan is right for you and your family.

One of the differences between an HMO and a traditional PPO is how service/care is provided or managed. With an HMO, you are not able to be seen by specialists or other service providers without seeing your primary care provider first. Your primary care provider must refer you to see a specialist. HMO plans may also have to pre-approve certain hospital and out-patient care as well. With a traditional PPO, you are able to see any provider you would like without having to go through your primary care provider first.

Another difference is the access to care. With traditional PPOs, they usually have a bigger network which means more access to in-network providers and hospitals/clinics. There is a better chance that your current provider is covered under a PPO network. An HMO plan generally has a much smaller network which means access to a provider of your choice or hospital/clinic is much more limited and sometimes not available in your area.

When comparing the HMO plan and the PPO plan to determine if the HMO plan is right for you, an HMO may be right for you if the cost savings is more valuable to you and your family and you do not mind taking extra steps to access specialty care along with maybe having to choose a new primary care provider.